Providing coal - mainly from domestic sources - to electricity producers helped to level off the costs of energy production and ensured its continuity in 2017-2018. Capital ties between the power industry and mining, following significant drops in coal prices in the global market, are making it difficult for electricity producers to decide to buy cheaper, imported coal. It is the case because the imported coal - although it could limit the costs of their operations - has an adverse effect on the return of funds previously invested by the power industry in the domestic coal sector.

Polish power plants, power and heat plants as well as heating plants which represent the so-called commercial power industry use up about 60% of coal. The purchase of coal makes up about 40% of that sector. Its optimal quality and price translates into electricity prices and competitiveness of the Polish economy. The audit dealt with the coal policy pursued by the electricity producers in 2017-2018, from the viewpoint of its economic justification and impact on the level of electricity prices. The audit covered electricity producers from 5 main energy groups: PGE (Polish Energy Group), ENEA, Tauron, ENERGA and PGNiG Termika (Polish Oil Mining and Gas Extraction), including their seven power plants, making about a half of the domestic production of electricity from coal.

Key audit findings

The trade in energy coal was dominated by bilateral contracts signed between its key domestic producers: Polska Grupa Górnicza S.A. (PGG) - Polish Mining Group, Lubelski Węgiel „Bogdanka” S.A. (LWB) - Lublin Coal ”Bogdanka”, Tauron Wydobycie S.A. (TWD) - Tauron Mining and companies linked by capital from the biggest energy groups: PGE, ENEA, Tauron, ENERGA and PGNiG Termika.

In 2017, the coal from the key domestic providers (PGG, LWB, TWB) met 86% of the demand for fuel on part of the audited energy producers and in 2018 it was only 77%. Periodic in 2017-2018 and worsening quality of domestic coal created the need to purchase imported coal. And so, in 2017 the seven audited electricity producers were provided with 17 million tonnes of coal of which only 100 thousand tonnes came from import (0.7%). In 2018, the total of 18.6 million tonnes were provided of which 1 million tonnes were imported (5.5%).

In 2017-2018, the prices of coal purchased from the key domestic producers for the needs of the audited electricity producers usually were competitive against the prices of other providers, including the imported coal providers. This is shown in the table below (prices per 1 GJ of energy contained in coal from a given source, purchased by the audited electricity producers).

Prices of domestic coal and imported coal including transport (PLN/GJ)

| Year | Domestic coal [PLN/GJ] | Imported coal [PLN/GJ] |

|---|---|---|

| 2017 | 8.5 ÷ 11.4 | 14.1 ÷ 16.1 |

| 2018 | 9.8 ÷ 13.7 | 15.6 ÷ 17.6 |

Source: NIK’s analysis based on audit results

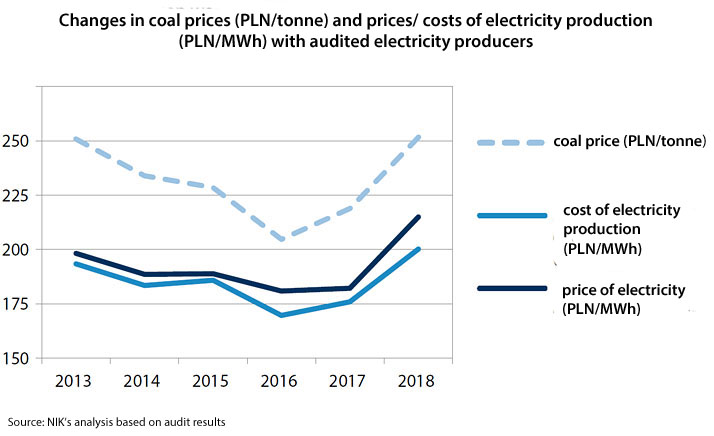

The purchased energy coal derived mainly from domestic sources and its import in 2017-2018 made up only 3% of deliveries. Although imported coal was more expensive at that time than domestic coal, those purchases should be considered justified as they were to make up the coal deficits in the market or improve the quality of fuel. In the long run, as is shown in the graph below, the fluctuations of average prices of coal burned by the audited electricity producers were reflected in corresponding changes in unit costs of electricity production and its sales price.

It should be noted that in the audited period the economic standing of most energy producers started to deteriorate. The factor that had significant impact on worsening financial results were the write-offs on fixed assets of energy companies. Other reasons included e.g. the 23% increase in average coal prices in 2016-2018 and the 65% spike in CO2 emission fees caused by growing prices of CO2 emission allowances. Particularly in 2018 those costs were a huge burden for the energy producers. The total share of both cost types in the produced energy costs went up from nearly 56% in 2016 to a bit less than 61% in 2018.

Coal was provided to energy producers at good purchase prices but the parameters of purchased coal were not fully tailored to the needs of specific energy production plants. The contracted coal usually met the quality requirements in terms of its basic parameters defined in the manuals for boiler plants. However, the coal often lacked the parameters expected by the energy producers that would also optimise the energy production costs (e.g. by reducing the costs of breakdowns and repairs). At the same time, only 4 of 7 audited energy producers additionally defined optimal coal parameters, e.g. expected physicochemical properties that would not only meet the cut-off requirements specified by the boiler plant producers but would also optimise the energy production costs.

When the physicochemical properties of coal differed from optimal ones, in some cases the coal had to be prepared for safe storage and combustion. It also happened that the work of production plants was disturbed. Also, the energy producers had to incur extra costs related to breakdowns.

Each time coal deliveries were examined in terms of the coal quality by accredited laboratories. Obligations related to the collection and preparation of samples for laboratory testing were defined in detail in effective manuals and the way of using test results was specified in contracts with providers. Regulations on coal management and their practical use enabled proper settlement of contracts signed with coal providers. Except for sporadic cases those regulations were properly applied.

All the audited energy producers had coal supplies ensuring production continuity. Besides, nearly all of them met their obligation to keep them at the required level. The reasons were usually independent of energy producers, such as: significant but short-term spikes in demand for electricity, delays in deliveries related to traffic restrictions on railroads but also extraction restrictions caused by geological and mining difficulties on part of coal producers. The coal producers informed the President of the Energy Regulatory Office about each case of the reduction in coal supplies, in line with effective regulations. Those incidents did not disturb the continuity of energy deliveries.

Energy producers managed waste from coal combustion in line with effective requirements. Most by-products of coal combustion were sold (88%), less often sent to energy waste landfills. In case of three energy producers the waste sales proceeds exceeded the waste management costs. Two energy producers implemented a project aimed at improving effectiveness of using coal combustion waste by maximising proceeds from its sale or products made on their basis as well by reducing the costs of waste management.

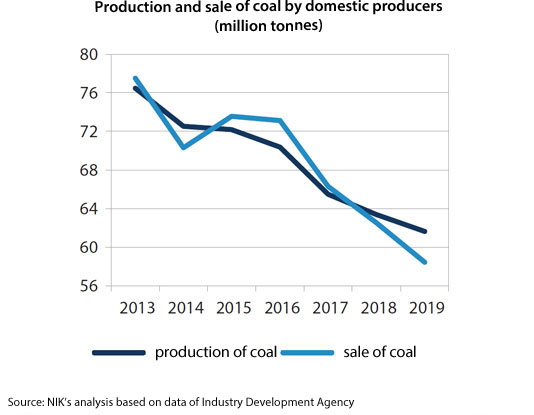

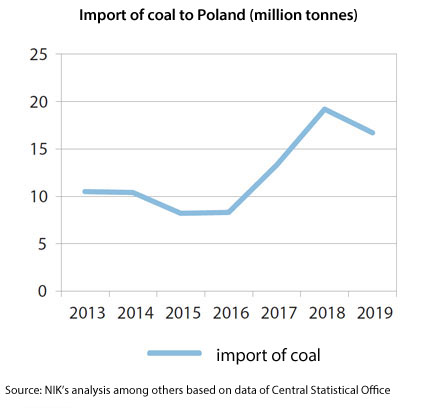

In the audited period (2017-2018), the prices of domestic energy coal were much lower than the prices of imported coal. That situation changed in 2019, when the coal prices plummeted in the global market. As a consequence, those prices levelled off about the first quarter 2019. From the second to the fourth quarter, the prices of imported coal remained at a level about 20-40% lower than the prices of domestic coal. The reduction of imported coal prices in 2019 established the trends of falling production and sale of domestic coal (see the graph below).

The increase in domestic coal prices in 2017-2018 was accompanied by an increase in coal import. However, the commercial power industry was not its main recipient because the share of that coal in satisfying its needs was small in that period. In 2019, the coal import remained high.

Diminishing competitiveness of the domestic production of energy from coal went along with an increasing share of imported electricity to meet the domestic demand. From 2016 to 2019, that share was: 1.2%, 1.3%, 3.2% and 6.3%, correspondingly.

Recommendations

Changeable conditions in the market of fuels and energy, including the decreasing prices of imported coal after 2018, high prices of domestic coal, capital ties of power and mining sectors as well as changes in the directions of the power sector policy worldwide, pose the risk of growing electricity prices, and hence of decreasing competitiveness of the Polish economy. At the same time, significant differences in the prices of electricity in Poland and in Europe generate the risk of excessive import of electricity. Therefore, NIK has requested the Minister of State Assets to make and document an in-depth analysis of an optimal model of provision of coal to the Polish electricity producers within a timeframe when the coal could be used for that production. Also, it should be analysed if the coal provision based on capital ties of the domestic power and mining sectors is justified.