NIK about the system of controlling postal and courier shipments with declared low values imported from non-EU countries

The existing system of verifying low-value shipments is ineffective. Domestic regulations on controlling such shipments are not adjusted to their massive scale. Also, the Polish Post (Poczta Polska S.A.) does not have any electronic data, essential for customs and tax control. This is a huge constraint for customs and tax authorities in identifying and controlling risky transactions. As a result, 99% of postal shipments and 96% of courier shipments of low value are admitted to the market without verifying if exemption from customs duties and taxes is justified in their case. Also, this is an encouragement for shipment senders to act against the law.

The Supreme Audit Office recommended that the Minister of Finance and the Polish Post implement a new, effective model of customs clearance for low-value shipments imported from non-EU countries.

System exemptions from customs duties and taxes for low-value shipments were implemented in the 80’s of the 20th century. The point was to reduce administrative burden and streamline work of customs services. Internet shopping at that time was in fact non-existent and the number of products which could be exempted from customs duties and taxes was quite small. Recently the situation has changed considerably. Intense development of the Internet trade and dynamic increase in the number of overseas shipments is a great challenge for customs and tax authorities in terms of control and collection of potential import duties. The volume of low-value shipments imported in the EU is 10-15% higher every year. These shipments are delivered to recipients by the appointed operator – the Polish Post and by courier companies. The polls show that every fourth Polish Internet user buys goods abroad.

In view of numerous press releases and parliamentary questions pointing to irregularities in that field, NIK conducted an audit of the effectiveness of supervision exercised by customs and tax authorities over the procedure of admitting goods imported in low-value postal and courier shipments from outside the EU to the market. NIK also verified how the Polish Post organised the presentation of postal shipments for customs clearance.

Key audit findings

The Minister of Finance and the Head of the National Revenue Administration identified problems of the existing system of controlling low-value shipments. However, until the end of 2019, no solutions were implemented to facilitate effective operation of customs and tax authorities in that field. As a consequence, the collection system for customs duties and taxes was not tightened. Above all, relevant legal and IT solutions were not adopted for that sake. There was no access to data that were supposed to help optimise risk analysis and increase efficiency of selecting shipments for customs and tax control. Besides, no tools were designed to verify occasional shopping or detect intentional division of orders aimed to evade import duties.

Neither the Minister of Finance, nor the National Revenue Administration (NRA) bodies, or the Polish Post had access to data about the real number of low-value imported shipments. For the needs of the NIK audit, those data were estimated by the auditees. The Polish Post did not agree (invoking the trade secret) to provide to the public the estimates with the number of low-value postal shipments from outside the EU, brought by that company to the market.

According to the estimates, the market of postal shipments (registered and non-registered) and courier shipments made up the total of 96% and 4% correspondingly of the total market of low-value shipments.

The shipments without customs duties and taxes, i.e. of the declared value below 22 Euro or so-called “gifts” represented 99.6% of low-value postal shipments and 78% of low-value courier shipments. Postal shipments without customs duties and taxes due to the simplified customs clearance procedures were not registered in IT systems of customs and tax authorities. It means that if they were not held for customs and tax control, they were forwarded for delivery to recipients, outside the IT systems.

Besides, the Minister of Finance and the NRA bodies had no information about the number of shipments for which customs and tax officers increased the declared value of goods and due payments received in that way (against the amount due resulting from the declared value of goods). According to NIK that could be due to common knowledge that most of submitted shipments should be paid for (are an outcome of the shipping order, so the VAT needs to be paid). But since there is no control option, the shipments are exempted from due payments which are not even accrued.

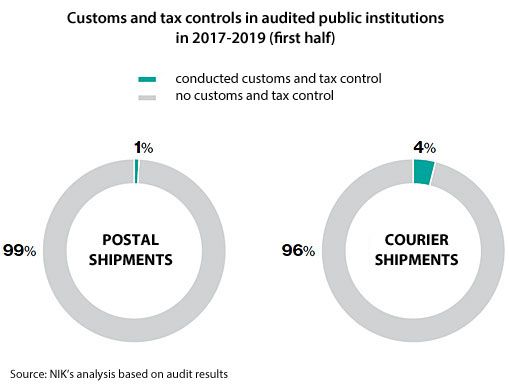

The supervision over the import of goods in postal and courier shipments of low values was based on physical controls of selected shipments. In view of the dynamically growing scale of e-commerce, in five audited customs and tax offices only 1% of postal shipments and 4% of courier shipments were verified in that way from 2017 to 2019 (first half). I means that in case of 99% of low-value postal shipments and 96% of courier shipments brought to the market, it was not verified if the exemption from import duties was justified.

Shipments were selected for customs and tax control mainly based on the experience and judgement of customs and tax officers. For instance, it was estimated that officers of the Masovian Customs and Tax Office (servicing 85% of the traffic of 5 audited entities), when presented with shipments by the Polish Post, had 15-20 seconds to decide whether to hold the shipment for control, transit it to another office or admit it to the market without verification. A few tens of thousands of postal shipments were presented in the Masovian Customs and Tax Office per day. It means that if every shipment was verified, that entity alone would have to hire 1.5-2 thousand officers extra.

According to NIK, the existing system of verifying low-value shipments, based on physical controls, not supported with any system risk analysis, is ineffective and uneconomic. The Polish Post did not provide any electronic data on the shipments to customs and tax authorities before physical presentation of the shipments. Therefore, no prior analysis or selection of shipments for customs and tax control was possible. The documentation accompanying postal shipments (paper customs declaration) did not allow verification of the declared value of goods or the way they were purchased. That would be possible e.g. upon checking an invoice, a bank transfer confirmation, a purchase confirmation from an auction portal). The absence of electronic data about postal shipments also made it impossible to verify if the order was divided into several smaller shipments with underestimated value (up to 22 Euro each), to evade import duties, or if it was incorrectly marked as gift. The very fact that a shipment was marked as gift does not mean that it was sent occasionally by an individual to another individual and that its actual value did not exceed 45 Euro.

According to NIK, the way the Polish Post organised the traffic of postal shipments in terms of presenting them to customs and tax authorities, did not facilitate effective supervision to the National Revenue Administration bodies over the shipment traffic, including fighting the evasion of import duties. At the same time, the Polish Post most often ensured proper conditions (in terms of office work and storage) for customs supervision and it cooperated in a required scope with customs and tax authorities.

As for courier companies, they provided customs and tax authorities with electronic data on shipments but in practice the tax administration lacked required IT tools to effectively analyse the data and the risk. The analysis in that area was conducted in line with general principles and did not take account of the specific nature of low-value shipments.

All the audited customs and tax authorities also pointed to unreliability of data placed by senders on TR transfer notes, customs labels and declarations in terms of the description of goods and their declared value. As a consequence, in order to check if the exemption of goods from customs duties and taxes is justified, the shipments need to be held for control to establish the real value of goods or the way they were purchased.

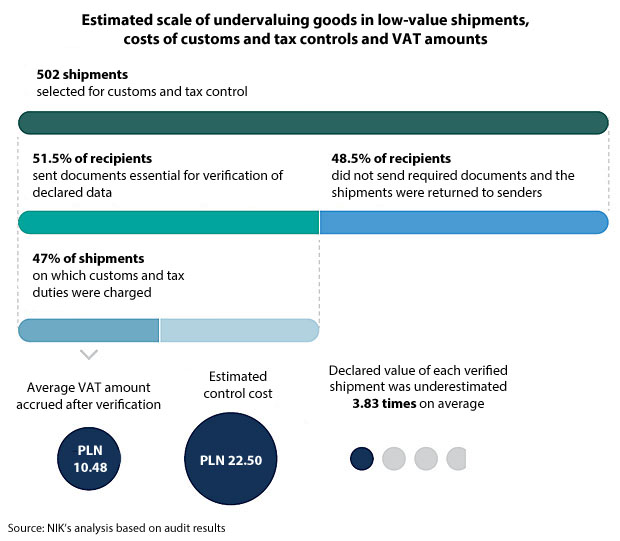

The customs and tax authorities carried out a detailed control of 500 shipments that would be admitted to the market without collecting the amounts due. The declared value of each verified shipment was on average nearly 400% lower than their real value. The average VAT amount calculated after the shipment check is PLN 10.5 but the estimated cost of the control (taking about 45 minutes) is as much as PLN 22.5. In view of the above, it may be stated that such controls are not justified in economic terms. Therefore, NIK stands in a position that it is so important to implement IT mechanisms and tools to optimise the risk analysis and increase efficiency in selecting shipments for control.

The Polish Post in cooperation with the Ministry of Finance took actions to digitalise data related to postal shipments imported from non-EU countries to the EU customs area. They also wanted to prepare for the new role related to making customs declarations for those shipments (currently the Polish Post only presents the imported shipments to customs and tax authorities). As initially scheduled, full digitalisation of data was to be completed by the end of 2020. In April 2019, though, the deadlines for implementing the telecommunications and IT systems were postponed. In case of systems on customs declarations for goods imported to the EU customs area – until the end of 2022, and in case of systems dealing with the short import declaration and the risk analysis – until 2025. Also the deadline for implementing and applying the so-called VAT e-commerce Directive has been deferred – now it is 1 July 2021.

According to NIK, the prolonging process of implementing proper changes by the Polish Post and putting off the implementation of the VAT e-commerce package will foster ineffectiveness of the system of controlling low-value shipments.

At the beginning of 2020, the Ministry of Finance changed the law in terms of customs clearance of courier shipments. It was about a collective declaration for duty-free goods and non-VAT exempt goods, where their total value in one shipment does not exceed the equivalent of EUR 150. The said changes overlapped with the provisions of the VAT e-commerce Directive.

In October 2020, the Ministry of Finance prepared a draft amendment to the VAT Act being the implementation of solutions provided in the so-called VAT e-commerce package to the domestic law. Now public consultations and the advising of the draft are in progress.

Recommendations

There is a risk that the new model of customs clearance in the market of postal shipments will not be implemented before 1 July 2021. It is also possible that the deadline for implementing the VAT e-commerce package will be postponed. The new tax regulations do not fully solve the problems of undervaluing goods imported in low-value shipments or using the so-called “gifts” for customs and tax abuses. In view of the above NIK has made the following recommendations:

to the President of the Council of Ministers:

- to take supra-ministerial efforts supporting the Minister of Finance and the Polish Post in terms of implementing the new model of customs clearance in the postal market;

to the Minister of Finance and the Head of the National Revenue Administration:

- to make sure the effective laws concerning the procedures and the form of making customs declarations for low-value shipments are complied with, or to implement changes in that area;

- to make sure the customs duties and taxes due to the import of goods in those shipments are paid, or to implement changes in that area;

- to shape public awareness in terms of fiscal duties related to the import of shipments from non-EU countries as part of the e-commerce;

to the President of the Management Board of the Polish Post (Poczta Polska S.A.):

- to intensify efforts to digitalise data on shipments, in a scope essential for customs and tax control.