Graphic description

The Supreme Audit Office of Poland negatively evaluates trends in the public finance system, as a result of which the state financial economy is run largely outside the state budget.

2022 was the third year in turn when diverse solutions were applied which violated fundamental budget principles and possibly even the Constitution of the Republic of Poland. Acting in the interest of citizens and the state NIK negatively evaluated trends in the public finance system, as a result of which the state financial economy is largely run outside the state budget, against the budget principles and – more importantly – outside the public finance sector. As a consequence, the Parliament and citizens have no control over a substantial part of public funds. In the past three years, the Budget Act, including the state budget in particular, stopped to play the role of the fundamental law on state finance management.

NIK evaluated execution of the Budget Act for 2022 in a descriptive form.

NIK stated that the state budget, the EU funds budget and financial plans of off-budget entities of the public finance sector were executed in line with the Budget Act for 2022. The Act, though, did not cover many significant financial operations having impact on the State Treasury debt increase.

NIK has also been alarmed by a significant drop in the share of positive evaluations as compared with the number of auditees in the past two years. In 2019, nearly 82% of the audited entities were evaluated positively, whereas in 2021-2022 that share went down to approx.70%. A reverse trend was observed in case of negative evaluations, the share of which more than doubled in the past four years.

Graphic description

DEFICIT OF THE STATE GOVERNMENT SUBSECTOR: PLN 101.7 billion

DEFICIT OF THE STATE BUDGET AND THE EU FUNDS BUDGET: PLN 14 billion

DEFICIT-REDUCING OPERATIONS IN 2022:

- FUNDS PROVIDED WITH FINANCIAL SUPPORT NOT USED UNTIL END OF 2021: PLN 31.8 billion

- NON-EXPIRING EXPENDITURES IN 2021: PLN 7.6 billion

- TREASURY BONDS PROVIDED IN 2022: PLN 25.8 billion

- TRANSFER OF FUNDS FROM STATE BUDGET REVENUES TO COVID-19 PREVENTION FUND: PLN 18.6 billion

DEFICIT-INCREASING OPERATIONS IN 2022:

- FINANCIAL SUPPORT PROVIDED TO COVID-19 PREVENTION FUND NOT USED UNTIL END OF 2022: PLN 11.7 billion

The state budget deficit and the EU budget deficit totalled in 2022 PLN 14 billion, which makes less than 35% of the planned value. That deficit level is distorted, though, and does not fully reflect the financial imbalance of the state. To illustrate, the value of the deficit of the state government subsector provided by Poland to the European Commission amounted to PLN 101.7 billion. It means that operations resulting in the deficit six times higher than the deficit of the state budget and the European funds budget were carried out off-budget. As a consequence of the solutions applied, the significance of the budget – as the key financial plan of the state and an elementary tool for public finance management - is being progressively minimised. An unprecedented situation has occurred where the state’s important tasks are financed outside the state budget and beyond the control of the Parliament.

Graphic description

Activities against fundamental budget rules have been taken on a very large scale for three years:

- funds financing public tasks were established in Bank Gospodarstwa Krajowego

- Treasury securities were provided free-of-charge to various entities

- tasks financed from the previous year’s budget were undertaken in the given year

The first factor distorting the said deficit value, as well as understating the significance of the budget as the principal financial plan of the state, has been the financing of a substantial part of public tasks outside the state budget since 2020.

This is about financing part of public tasks from the money of funds established outside the public finance sector and supported by Bank Gospodarstwa Krajowego.

Two other funds were established in 2022 that were allocated public tasks and were not governed by the Act on Public Finance (Aid Fund and Armed Forces Support Fund). The list of tasks performed by the COVID-19 Prevention Fund was extended. Since the name and the objective of the Fund are very general in the establishing Act, the Fund has in fact become a tool to finance any scope of tasks. Unfortunately, NIK audits in the area of financing state tasks outside the budget revealed numerous and significant irregularities. NIK has negatively evaluated the way the President of the Council of Ministers managed the COVID-19 Prevention Fund.

The existing legal and organisational solutions made it possible to finance a range of important public tasks from the COVID-19 Prevention Fund but they did not ensure effective management of the Fund’s finance. Both the system of using funds provided to beneficiaries from the Government Fund for Local Investments and the management of money located on the Fund’s account were considered ineffective. Major reservations of NIK were also related to the process of developing the Fund’s financial plan as well as transparency and reliability of the application review.

NIK’s findings imply that the process of reviewing applications was undocumented and non-transparent. Statistically, it took the relevant commission a dozen or so seconds to review one application for money from the Government Fund for Local Investments which reviewed over 24 thousand applications for nearly PLN 7 billion!

Substantial and numerous irregularities were also found in the audit of the Polish Development Fund (Polski Fundusz Rozwoju S.A.) in terms of effects of selected activities taken by the state to mitigate consequences in the economy.

In other words, it may be stated that the funds planned for public tasks outside the Budget Act are not only beyond control of the Parliament and citizens but are also spent against all principles and rules, with a high risk of discretion and corruption.

Public tasks have been financed on such a large scale for the first time in the past three years. At the end of 2022, Bank Gospodarstwa Krajowego supported 20 funds, 11 of which were established after 2019. The proceeds and expenditures of those funds exceeded PLN 100 billion, which was an equivalent of about 3.5% of GDP. Since the beginning of 2023, Bank Gospodarstwa Krajowego has also supported the Government Road Development Fund, which has operated to date as a special purpose fund of the state .

Another factor distorting the deficit value is the free-of-charge provision of the Treasury securities to various entities – a phenomenon that has intensified in recent years.

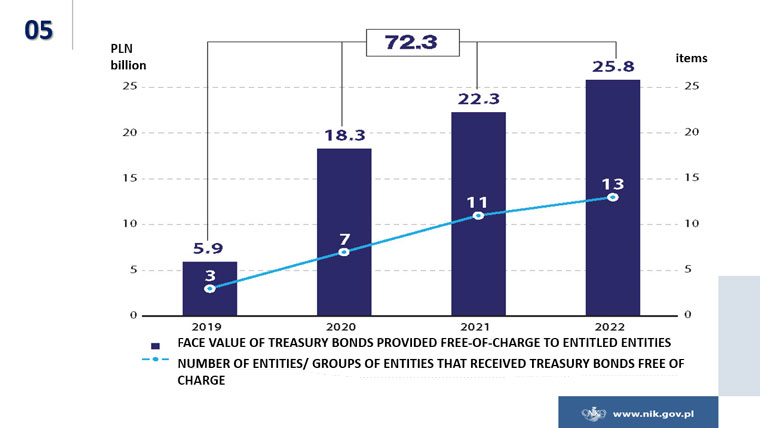

Graphic description

FACE VALUE OF TREASURY BONDS PROVIDED FREE-OF-CHARGE TO ENTITLED ENTITIES

+ NUMBER OF ENTITIES/ GROUPS OF ENTITIES THAT RECEIVED TREASURY BONDS FREE OF CHARGE

- 2019: PLN 5.9 billion, 3 entities;

- 2020: PLN 18.3 billion, 7 entities;

- 2021: PLN 22.3 billion, 11 entities;

- 2022: PLN 25.8 billion, 13 entities.

TOTAL VALUE OF TREASUY BONDS PROVIDED: PLN 72.3 billion

In 2022, the Treasury securities of the face value of PLN 26 billion were provided free of charge to various entities beyond the expense account of the state budget, and thus also outside the state budget total. The total value of that financing in 2019-2022 exceeded PLN 73 billion.

The deficit value in 2022 was also impacted by operations carried out at the end of 2021 when the list of expenditures that did not expire at the end of the budget year was established at PLN 7.6 billion and payments of PLN 31.8 billion to various funds were made. Those solutions enabled the financing of a range of tasks in 2022 without impacting this year’s result.

NIK underlines that although the support was justified, it was not provided in line with the Budget Act. Also, it had a substantial impact on the deficit of the state and local government sector as well as its debt increase.

It needs to be emphasised that the role of the state budget is minimised by financing a considerable part of tasks outside that budget. Also, in that case the Budget Act – against the principle set out in the Public Finance Act – is no longer the basis for the state financial economy in a given budget year. The fundamental nature of the state budget arises directly from the Constitution of the Republic of Poland. The Constitution has the supreme legal power in the system of legal sources in a state and no other acts should lead to ignoring its provisions.

“Unfortunately, it has not been the case in the past three years. It can be observed in this year’s Analysis of execution of the state budget and the monetary policy assumptions.” – NIK President stated.

The Supreme Audit Office of Poland finds no justification for violations of fundamental budget rules, such as the principle of openness, transparency, annuality, unity and universality of the budget.

Graphic description

PUBLIC DEBT

| Type | 2021 | 2022 | ||

|---|---|---|---|---|

| PLN billion | % of GDP | PLN billion | % of GDP | |

| CONSOLIDATED PUBLIC DEBT | 1 148.6 | 43.8 | 1 209.6 | 39.3 |

| GENERAL GOVERNMENT DEBT | 1 410.5 | 53.8 | 1 512.2 | 49.1 |

Both the State Treasury debt and the general government debt increased in 2022 by over PLN 100 billion. However, the dynamics of the State Treasury debt increase was over two times higher than a year before. At the end of 2022, the general government debt exceeded PLN 1.5 trillion. The cost of service of the State Treasury debt totalled PLN 32.7 billion and its share in the budget expenses was 6.3%. The Supreme Audit Office of Poland points to the risk of an increase in the debt service cost in the coming years.

The ratios of the consolidated public debt and the general government debt to GDP at the end of 2022 were 39.3% and 49.1%, correspondingly. The decrease of the ratios against the end of 2021 was not an outcome of a limited scale of the debt but of a significant increase of the GDP face value. That increase resulted from high inflation in 2022, which reached 16.6% in December last year.

Graphic description

Consolidated public debt of PLN 1 209.6 billion + PLN 302.6 billion = general government debt of PLN 1 512.2 billion

At the end of 2022, there was a record gap between the public debt calculated in line with the EU methodology and the debt established according to domestic rules.

At the end of last year the general government debt was over PLN 302 billion higher than the consolidated public debt!! It made up 9.8% of the Gross Domestic Product.

Besides, it needs to be stressed that in 2020-2022 Bank Gospodarstwa Krajowego and Polski Fundusz Rozwoju S.A (Polish Development Fund) contracted liabilities of PLN 240.3 billion to acquire funds for public tasks. According to NIK’s estimates the costs of servicing bonds issued by Polski Fundusz Rozwoju S.A. and by Bank Gospodarstwa Krajowego for the COVID-19 Prevention Fund and the Aid Fund will be higher in the entire maturity period by over PLN 12 billion than if that debt was contracted directly by the State Treasury!!!! Therefore, that way of financing state tasks is – according to NIK – economically unjustified.

In view of the above, public statements of the Ministry of Finance are even more upsetting and horrifying. They boil down the debt definition to a purely statistical item which does not entail any consequences except for the reporting obligation.

This shows the scale of understating the category which clearly defines the condition of the state finance, including its actual, real debt.

NIK President Marian Banaś underscored that the total of PLN 300 billion stands for an actual debt that will be repaid by future generations for many years.

NIK auditors revealed a range of irregularities related to the execution of the Budget Act for 2022.

Graphic description

Other areas with most irregularities:

- accounting records and reporting

- management control

- use and settlement of subsidies

- public procurement

The most frequent irregularities are related to public procurement, account books, reporting, granting and settlement of subsidies and management control. NIK identified both violations of effective regulations and unreliability in the operations of the state authorities. The following activities were taken without consent of the European Commission:

- an earmarked subsidy was granted to Polska Grupa Górnicza S.A. (Polish Mining Group) for the capacity reduction bonus of PLN 800 million,

- the Minister of Finance extended guarantees of PLN 24.6 billion for liabilities contracted by the entities e.g. to ensure continuous gas fuel deliveries,

- bonds worth over PLN 1 billion were issued to mining companies.

Another illegal activity was granting earmarked investment subsidies of PLN 6 million by the Minister of Education and Science to three non-eligible entities. NIK also identified an example of wastefulness: a term deposit of the Armed Forces Modernisation Fund for PLN 6 billion was withdrawn without reason. As a result, revenue of nearly PLN 32 million was lost. In 2022, the Police finished the year with liabilities due for over PLN 47 million. Major irregularities were also detected in other public institutions, such as the Eye Tissue Bank or the Medical Fund. NIK has negatively evaluated their activity.

NIK presented detailed results of the audit of the state budget execution in 2022 in separate documents provided to the Marshall of the Sejm and Parliamentary Committees in the middle of June this year.

Graphic description

MONETARY POLICY

In December 2022, the inflation level reached 16.6% and the mid-year inflation rate was 14.4% - those were the highest levels since 1997.

The inflation level skyrocketed in 2022 to levels not reported in 25 years. In October 2022, the annual inflation rate reached 17.9% and was the highest in 2022. The average yearly growth rate of consumption prices in 2022 amounted to 14.4%. It was 10.9 percentage points above the upper limit of acceptable deviations from the inflation target set in the Monetary policy assumptions for 2022.

Until the end of September 2022, the Monetary Policy Council consistently continued the interest rate increase cycle started in October 2021. That was justified in the inflation forecasts and considered justified and adequate by NIK.

The price increase was influenced both by external factors, as underlined by the Monetary Policy Council, and the factors which the National Bank of Poland could impact with the monetary policy instruments.

In October 2022, the Monetary Policy Council changed its approach and suspended its interest rate increase cycle, despite great uncertainty in terms of risks having impact on the inflation. The Council did it, although it lacked clear arguments to support that decision, and the inflation rate reached 17.9% in October 2022, which is the highest level since 1997.

Forecasts of the National Bank of Poland included data indicating potential weakening of the economic situation in Poland. The Council assumed that when the factors resulting in a significant inflation increase in 2022 are eliminated, the inflation rate should return to the target set in the Assumptions.

According to NIK that priority shift could be considered contradictory to the Act on the National Bank of Poland which says that the primary goal of the National Bank of Poland is to maintain a stable price level, while supporting the government’s economic policy, provided that it does not constrain the primary goal.

Besides, NIK stands in a position that adopting that strategy may stand for a slow-down in getting back to the inflation goal of the National Bank of Poland.

The high inflation has already resulted in impoverishment of the society. The reason was a permanent loss of the currency purchasing value, referred to as the “inflation tax” by finance experts. According to estimates made by the Supreme Audit Office, the tax value may be estimated at PLN 150 billion at the minimum and its burden was carried chiefly by households and non-financial corporations.

Graphic description

Audit recommendations for the National Bank of Poland:

- to eliminate inconsistencies in the communication of the National Bank of Poland,

- to implement transparent process of making expert corrections in the NECMOD model,

- to use all instruments available to achieve the primary goal of the monetary policy.

In the first half of 2022, the Monetary Policy Council tightened its monetary policy and stated that it intended to counteract the growing inflation. In the second half of 2022, though, the National Bank of Poland signalled that the inflation and the interest rates could be possibly going down, which was incomprehensible and inconsistent with the current situation and could have an adverse effect on the credibility of the National Bank of Poland, and hence on the effectiveness of its operations.

In 2022, the Management Board of the National Bank of Poland achieved an operational objective of the monetary policy, being the maintenance of short-term interest rates in the interbank market, close to the NBP reference rate. However, when the NBP reference rate is fixed at a level which does not ensure stability of prices, achievement of the operational objective does not translate into achievement of the inflation objective.

Despite high inflation rates in 2022, the National Bank of Poland did not use the opportunity to issue bonds which could be an additional instrument to prevent the price increase. That option was provided for in the Act on the National Bank of Poland and the Monetary policy assumptions for 2022.

Having got familiar with the Analysis of execution of the state budget and the monetary policy assumptions, the Council of NIK passed a resolution on 7 June 2023 where it expressed its opinion on the discharge for the Council of Ministers for 2022. The resolution includes key findings of the budget audit and changes in the public finance system since 2020, as a result of which the state’s financial economy is largely run outside the state budget, against the budget principles. The Supreme Audit Office of Poland has negatively evaluated those changes. This is the first time since 1994 that the Council of NIK did not approve granting discharge to the Council of Ministers.

Graphic description

Council of NIK:

The Council of NIK has negatively evaluated trends in the public finance system in the past few years.

It also indicated the necessity to:

- restore transparency of public finance

- restore the position of the central financial plan to the state budget, in line with the Constitution of the Republic of Poland

- restore the role of the fundamental state finance management regulation to the Budget Act, reflecting the state’s revenue and expenditures

The Council of NIK indicated the necessity to take efforts to restore transparency of public finance. At the same time, it pointed to the need to restore the position of the central financial plan to the state budget, in line with the Constitution of the Republic of Poland. The Council of NIK stressed the urgency to stop redistribution of funds for the financing of state tasks outside the Budget Act. According to the Council it is essential that the Budget Act restores the role of the fundamental state finance management law, reflecting the state’s revenue and expenditures.

NIK President expressed his concern about a growing threat to democracy, which is the progressive lack of openness and transparency of public finance in Poland underlying the democratic state of law. Huge-scale financial operations leading to an increase of the public debt outside the state budget and allowing any result in the state budget confirm that debudgeting of the public finance has taken place on a scale unseen in 26 years of the Constitution.

In view of the above NIK President made a thesis that systematic disintegration of the state management through public finance has been going on in Poland and that political and legal responsibility for that management has been waived at the same time.

NIK President asserted that depriving the Budget Act of its political position by boiling it down to the role of a “robot” paying allowances due to specific statutory obligations is about destroying democracy and about taking away elementary rights of the legislative towards the executive.

The Budget Act is a law which is the source of knowledge for most citizens on what public tasks will be undertaken in a given budget year, whereas the state budget should be perceived as the supreme financial plan, approved by the Parliament. “These proportions have gone wrong today, though!” – NIK President stated. “Continued dissipation of the public finance management, this financial engineering will finally lead to the waiver of any political and legal responsibility for that management. There may be no consent to that!” – Marian Banaś said, closing his speech.