In 2020, the state budget was executed by means of diverse solutions. Although in accordance with the law – they disturbed transparency and the annual nature of the budget.

For the first time in its history, NIK made a descriptive evaluation of the Budget Act execution for 2020.

The great majority of NIK’s evaluations of single audits were positive. However, their number in the overall structure of evaluations went down against 2019 by nearly 4 percentage points. At the same time, the scale of descriptive evaluations went up (to 47 in 2020). One evaluation made by NIK was negative and in one case NIK did not make any evaluation.

According to the Supreme Audit Office, the state budget and the European funds budget were executed in line with the Budget Act for 2020. All limits set out in the Act related to budget expenditures and outflows, budget deficit, debt as well as the State Treasury sureties and guarantees were complied with. However, many operations related to the financing of measures to prevent and fight COVID-19 were excluded from those limits.

The state budget execution report of the Council of Ministers for 2020 was developed based on data recognised in reports of individual users of the state budget and effective legal regulations. The data in accounting books covered by the audit reflected the nature of the operations performed.

In 2020, many mechanisms lowering transparency of the state budget execution were applied. Therefore, the report does not reflect all operations that had an impact on the condition of the government sector finance.

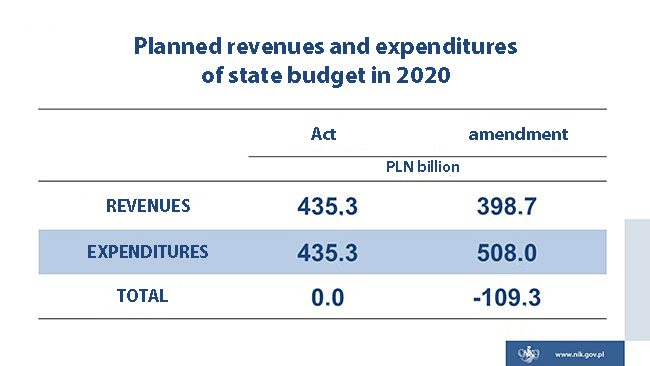

Initially, it was planned in the Budget Act for 2020 to balance the state budget revenues and expenditures. That was possible due to a range of legal solutions, which enabled the financing of public expenditures at PLN 20.7 billion from off-budget funds.

The state budget execution conditions worsened because of the developing COVID-19 epidemic. As a consequence, the Budget Act was amended on 28 October 2020. The amendment resulted in an update of basic macroeconomic parameters and budget figures. In particular, in place of the previously predicted balance, the state budget deficit was established at PLN 109.3 billion.

Large financial operations concerning important public services were planned and carried out beyond the state budget expenditures and deficit in 2020. Some of these operations allowed state budget expenditures to be recognised in periods other than those in which they were actually incurred.

An example of an operation beyond the state budget was the gratuitous transfer of Treasury securities of PLN 18.3 billion to eligible entities under acts other than the Budget Act. The beneficiaries included: universities, infrastructural companies, Telewizja Polska S.A. (Polish Television), Polish Radio, Polski Fundusz Rozwoju S.A. (Polish Development Fund Group) and Bank Gospodarstwa Krajowego. Another example was the extension of interest-free loans to the Solidarity Fund totalling PLN 15.5 billion (the Fund already had some liabilities due to loans of nearly PLN 13 billion).

Also, the expenditures earmarked for COVID-19 prevention and fighting were predominantly financed beyond the state budget. From the state budget and the EU funds budget, only PLN 23.3 billion was earmarked for that purpose, which accounts for less than 4% of the total expenditures from those budgets. The Budget Act did not include the amount of PLN 166.1 billion acquired as a result of debt incurred by Bank Gospodarstwa Krajowego for the COVID-19 Prevention Fund and Polski Fundusz Rozwoju S.A.

The issue of bonds for purposes related to COVID-19 causing an increase in the state’s liabilities did not raise the value of the public debt calculated in line with the Polish methodology. The applied solution, which was to prevent exceeding the prudence threshold of 55% of the GDP, caused an increase in costs incurred by the public sector. The reason is that the service of debt incurred by Bank Gospodarstwa Krajowego and the Polish Development Fund entails higher costs than the service of debt incurred directly by the State Treasury. Most probably, the repayment of debts incurred by those entities will be charged to the State Treasury.

The financing of financial and anti-crisis shields in a form which is not included in the debt calculated using the Polish methodology, and only by means of the EU methodology, resulted in the biggest-ever difference between the general government debt and the public debt at the end of 2020. That difference increased over four times against previous years and reached PLN 224 billion. That was nearly 10% of GDP and 20.2% of the public debt.

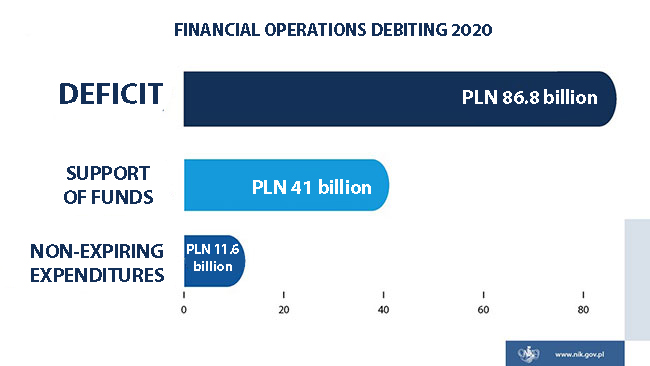

Some financial transactions enabled the state budget expenditures to be recognised in a period other than the one in which they were actually incurred. They included state budget expenditures of over PLN 41 billion, transferred in 2020 to the Solidarity Fund, the COVID-19 Prevention Fund and the Government Road Development Fund. Those expenditures were not used by the end of 2020.

Another example of financial operations formally increasing the state budget deficit in 2020 were non-expiring expenditures. In 2019, expenditures of that type were set at less than PLN 140 million, whereas in 2020 it was nearly PLN 12 billion. As the deadline for their execution is 30 November 2021, this means that two budgets are being executed this year.

Such a big scale of non-expiring expenditures also limited the parliamentary audit. The reason is that in the period when the state budget execution in 2020 is being discussed, expenditures allocated to 2020 could be executed for many months more.

Such financial transactions, although in accordance with the law, decrease transparency of public finance, and also limit effectiveness of other regulations, in particular referring to the limit of public expenditures or public debt.

In view of these findings, NIK has pointed to the need to plan expenditures for important public tasks in the Budget Act, particularly in the state budget. It is also worth having a debate about how to eliminate differences in presenting revenues, expenditures, deficit and public debt, in line with the Polish and EU methodology.

Other irregularities identified by the Supreme Audit Office with regard to the state budget execution in 2020 were related mainly to unjustified and uneconomical spending, flaws in granting and using subsidies, and errors in the accounting register and budget reports. In other words, these are issues recurring on a yearly basis.

Detailed results of NIK audits were presented in separate audit reports submitted to the Speaker of the Sejm and Sejm Committees in the middle of June 2021.

NIK positively evaluated the execution of the Monetary policy assumptions in 2020.

The Council of NIK, having studied the Analysis of execution of the state budget and monetary policy assumptions in 2020, passed a resolution on 9 June 2021 where it approved granting discharge to the Council of Ministers for 2020. At the same time, the Council of NIK pointed to the need to improve transparency of public finance.