This audit is an aftermath of another NIK’s audit in 2019 concerning GetBack - a debt collection company. At that time, NIK found that state institutions did not provide effective protection of non-professional participants of the financial market from illegal activities of GetBack SA or entities offering and distributing the company’s securities. In particular, the Polish Financial Supervision Authority (UKNF) in the first five years of the GetBack’s operation did not audit it at all. Also, UKNF failed to identify signs pointing to irregularities based on information provided by the company, its auditors and other cooperating entities.

NIK undertook this audit also based on media reports about dishonest practices of entities operating in the investment fund market. Audits conducted by UKNF revealed a range of irregularities which were not identified before. For instance, investment fund companies did not ensure security of trade or conduct in the interest of the fund participants. KNF identified some irregularities also related to the conduct of funds’ depositaries.

At the end of 2020, there were 56 investment fund companies and 737 investment funds operating in the market. 145 funds were in liquidation.

Key audit findings

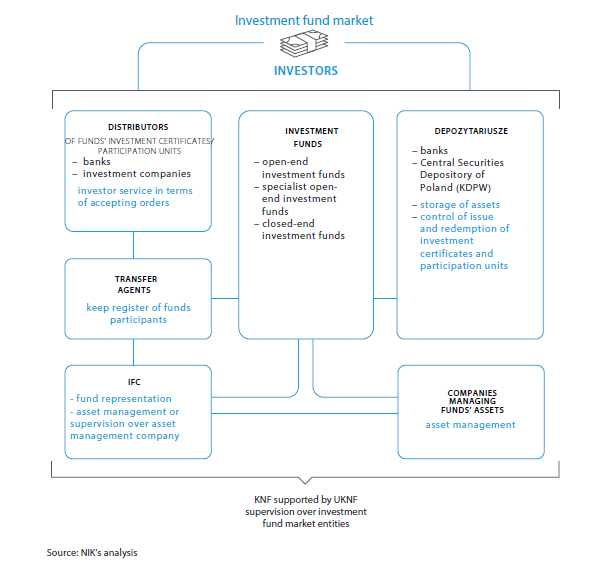

Pursuant to the Act on Capital Market Supervision, KNF and UKNF are obliged to supervise investment funds, investment fund companies which represented those funds, depositaries of investment funds, distributors of funds’ investment certificates and participation units (banks, brokerage houses) or entities managing funds’ assets.

Graphic description

The following entities provide investor services in the investment fund market:

- INVESTMENT FUNDS

- open-end investment funds

- specialist open-end investment funds

- closed-end investment funds

- DEPOSITARIES (banks, Central Securities Depository of Poland: KDPW)

- storage of assets

- control of issue and redemption of investment certificates and participation units

- INVESTMENT FUNDS COMPANIES (IFC)

- fund representation

- asset management or supervision over asset management company

- COMPANIES MANAGING FUNDS’ ASSETS

- asset management

- TRANSFER AGENTS

- keep register of funds participants

- DISTRIBUTORS OF FUNDS’ INVESTMENT CERTIFICATES/ PARTICIPATION UNITS (banks, investment companies)

- investor service in terms of accepting orders

Supervision over investment fund market entities is exercised by KNF supported by UKNF

Source: NIK’s analysis

The audit revealed system weaknesses in the funds supervision which may impact stability, transparency, security and trust in the financial market. They may also affect protection of its participants.

NIK pointed out that the systems for processing data from reports had limited capacity for efficient data verification. That is why, it was difficult to quickly identify errors and irregularities arising from reports filed by various entities. Those systems should among others allow automatic comparison of some financial data in financial reports submitted to KNF.

Until 2020, there were no internal regulations on the method of verifying data included in reports or controlling investment activity and financial standing of investment funds. Those regulations would allow more effective performance of those tasks in case of high employee turnover. UKNF undertook works to strengthen its supervision on a system basis, which NIK evaluated positively. According to NIK these works should be finalised to make supervision more effective, taking into account the changing legal environment.

NIK indicated several system weaknesses in KNF. One of them was a small number of audits. As a consequence some irregularities cannot be identified based on reports sent to KNF and analysed as part of on-going supervision. What makes matters worse is the high turnover of employees responsible for supervision over investment fund market entities. Higher financing of UKNF (since 2019) should foster improvement in this area. NIK positively evaluated works UKNF started in 2020 to increase headcount in a department responsible for the investment fund market supervision. Also, before 2018, UKNF failed to give supervisory recommendations to investment fund companies, which NIK considers as another system weakness.

Recommendations

NIK addressed a number of recommendations to the Chair of the KNF Board. They are related to modifying reporting systems, implementing audit planning procedures, selecting auditees, expanding the scope of information in UKNF’s cyclic documents on IFC, presenting description of key irregularities in KNF’s cyclic documents and complementing the fund audit instruction implemented in 2020.

NIK also submitted two de lege ferenda proposals to the minister responsible for financial institutions, in cooperation with UKNF. The first one is related to expanding the catalogue of irregularities in the provisions of law, where the persons directly responsible for them could be covered with sanctions. In the second proposal, NIK recommends loosening regulations on the protection of the KNF/UKNF professional secret. The point is to facilitate the pursuit of claims to aggrieved investors before courts of general jurisdiction.