Since Poland accessed the European Union, social contributions have been charged among others based on wages of Polish employees posted to work in other EU countries. In some countries, for instance in Germany and Austria, contributions on holiday pays and compensations for unused holiday are charged and accrued by the so-called holiday pay funds. In Poland, such institutions do not exist. Therefore, Polish employees posted to work in those countries are required to be part of a holiday pay fund. It means their employers are obliged to pay contributions to that fund. In case of default, they have to pay fines.

Until January 2014, the Austrian holiday pay fund (BUAK: Construction Workers' Annual Leave and Severance Pay Fund) accrued contributions on holiday pays and compensations for unused holiday, paid to posted employees, without transferring that money to ZUS. In case of the German holiday pay fund (SOKA-BAU: Service and Security for the Construction Industry), until June 2018 contributions due to such compensations were transferred to employers. Only as a result of agreements between the Polish party and BUAK as well as between ZUS and SOKA-BAU the situation changed and contributions accrued by those funds were transferred directly to ZUS. According to the data acquired by NIK, in 2004-2019, nearly 1.4 million Polish employees were posted to work in the EU countries other than Austria and Germany.

ZUS ensured the transfer of holiday pay contributions to ZUS by holiday pay funds operating only in two countries – Austria and Germany. ZUS did it with a few years’ delay, though. Besides, in case of Austria that was a follow-up of the intervention between ZUS and the Ministry of Labour and Social Policy. With regard to other EU countries, ZUS tried to establish the mode of operation of holiday pay funds only in October 2019 in response to the NIK audit.

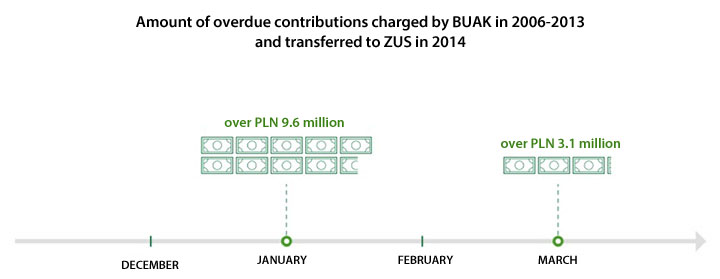

An amount exceeding PLN 12.7 million of overdue contributions for 2006-2013 charged by the Austrian holiday pay fund was transferred to ZUS only following an agreement made on 5 November 2013. The Polish Social Security Institution did not charge any default interest due to the delayed transfer of funds. It means that the financial consequences of that delay were paid by posted employees. According to NIK estimates, the default interest totalled more than PLN 800 thousand.

Source: NIK’s analysis based on audit results

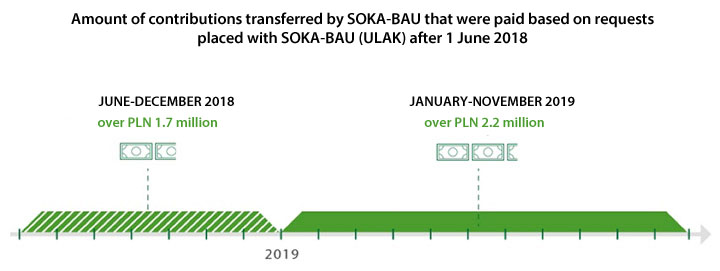

An agreement with the German holiday pay fund (SOKA-BAU) was made only on 24 May 2018, although consultations in that matter were going on for over 10 years. The agreement was signed after the change of regulations which enabled ZUS to implement the e-Contribution project which allowed making payments on individual contribution accounts. Until December 2019, SOKA-BAU transferred to ZUS contributions totalling nearly PLN 4 million.

Source: NIK’s analysis based on audit results

For 15 years, ZUS did not take any actions to determine the number of holiday pay funds or the way they operate in the EU countries other than Austria or Germany. As a result, no cooperation was established with such funds, although the risk was high that the employees posted to work in the EU countries other than Austria and Germany were not protected enough in terms of contributions charged by holiday pay funds. For instance, such contributions may not be recognised on individual accounts of the insured in required amounts and on required dates.

As a result of the audit, ZUS headquarters took actions to determine in which EU countries other than Austria or Germany holiday pay funds operate. ZUS President declared his readiness to establish cooperation with the Ministry of Family, Labour and Social Policy. He also started talks on possible changes to the law on social insurance to regulate the issue of paying funds being the contribution assessment basis in a foreign currency.

Preliminary information obtained by NIK from the Supreme Audit Institutions operating in the EU countries shows that holiday pay funds and similar institutions and systems are in place not only in Austria and Germany, or Belgium and France as indicated by ZUS, but also in Cyprus, Estonia, Greece and Sweden.

Recommendations:

NIK has made the following recommendations after the audit:

- to the Minister of Family and Social Policy (system recommendations):

- strengthen supervision over ZUS operation in terms of providing social security services to the employees posted to work abroad

- analyse consequences of the solutions adopted following negotiations with BUAK and take actions, based on the analysis results, to develop mechanisms facilitating compensation of benefits lost by persons posted to work in Austria

- to ZUS President:

- ZUS should convert the contribution assessment basis from a foreign currency into PLN in accordance with applicable law or initiate a law change in that respect

- ZUS headquarters should intensify research on holiday pay funds (in which countries they operate and based on what principles). In case ZUS learns that some of those holiday pay funds fail to transfer charged funds to the contribution payers, it should immediately start to cooperate with those funds.