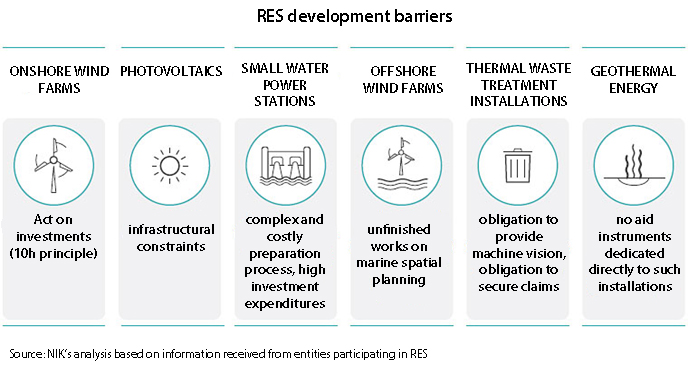

Key barriers in the renewable energy development include: limited possibilities of financing investments by entrepreneurs, legal regulations on providing assistance, administrative and procedural difficulties, as well as problems with the operation of power transmission grids. The possibility to support investments and development of renewable energy sources (RES) is underpinned by the EU power policy. The primary obligation for Poland related to the implementation of the EU directive was to achieve at least 15% of the RES energy share in the gross final energy consumption in 2020. The gross final energy consumption includes electric energy consumption, energy consumption in transport as well as heat and refrigeration engineering. The share of energy used in transport had to reach at least 10% in 2020. To meet those objectives a financial aid system was needed for entrepreneurs interested in investing in ecological energy sources, to encourage them to use RES in all three sectors.

Since 2005, there has been a support system in Poland providing a guarantee to producers that they can purchase electric energy from renewable sources. In 2015, the Act on RES resulted in transferring some provisions on renewable energy sources from the Energy Law to the new Act on RES and implementing the auction system. In 2016 and 2017, the auction winners were the auction participants who offered the lowest selling price. Only the Act on amending the Act on RES of 2018 introduced the so-called forced competition rule. Final data on the RES energy share in the gross final energy consumption will be available only at the end of 2021 or at the beginning of 2022. This audit was undertaken among others because the target of 15% share of RES energy in the gross final energy consumption is highly likely not to be met by the end of 2020. The purchase of such energy from other countries or a penalty for Poland became a real threat.

NIK audited the Ministry of Climate and Environment and the Energy Regulatory Office. The audit covered the period from 2017 to 2020 (1st half).

Key audit findings

The Minister failed to provide a system of regular and consistent monitoring of the subsector producing electricity from RES. There was no effective method to obtain complete information about issues in RES development. The Minister gained knowledge about problems in RES functioning from ad hoc activities. The lack of comprehensive analyses to identify problems and barriers in RES development made it impossible to implement overall changes. Despite numerous amendments to the RES Act, works were still pending to amend the applicable law.

In the audited period, the Minister did not monitor the RES development barriers. He did not evaluate consequences of changes implemented by the Act on wind farm investments in 2016. No analysis was made of how the “10h principle” introduced with that Act impacted the reduction of wind farm investments. The 10h principle defined the minimum distance between a residential building and other facilities and a wind power plant with the capacity not exceeding 40 kW (in 2018 the minimum was changed to 50 kW). The Minister did not analyse the impact of the new provisions of law on the trade in machines for the construction of onshore wind farms and on the labour market. He did not even start works on changing the Act on investments (in particular on changing the 10h principle provisions), although he knew about the slump in onshore wind power investments after 2016.

Due to several changes of the wind farm definition having impact on the real estate tax, the Minister did not estimate the reduction in revenues of local government units due to that tax. Besides, no compensations were assumed for communes which planned their revenues based on the wind farm definition effective from 2016. In line with the Ministry’s estimates, the issue of compensations for communes concerns about 140 communes (less than 6% of the total number of communes in Poland).

From 2018, works were intensified to reduce barriers in RES development. The Act on RES was amended in 2018 and 2019. As a result, the system became more efficient. In 2018-2020, more than 201 TWh electric energy was contracted, whereas in 2016-2017 it was less than 8 TWh. For producers having micro-, small and medium installations using hydropower or biogas, a support system was created involving a fixed, guaranteed purchase price.

The amended Act also brought about a new term – prosumer (from the words producer and consumer). This is a person who produces electric energy from renewable sources for their own needs and may at the same time store and transfer the energy surplus to a power grid. The prosumer mechanism was introduced with the Act. Also the concept of a power cooperative was implemented, which is a type of a collective prosumer.

Despite statutory changes, the Minister did not publish three executive acts on the activity of prosumers and power cooperatives.

Also ordinances specifying the reference price in 2019 and 2020 were not developed in due time. The Minister did not make sure that the reference price was effective for the whole year for which it was fixed. Also legal acts setting out the quantity and the value of energy which could be sold in auction in 2018-2020, were published with several months’ delay.

Although the Act provided for assistance for hybrid and modernised installations, their owners could not benefit from this aid.

In 2016-2020, there was an increase in the number and installed power of new installations producing electric energy from RES. As a result of auctions held in that period over 209 TWh electric energy worth over PLN 50.7 billion was contracted. Most of the contracted energy came from wind power plants and photovoltaic installations, much less from biogas plants and water power stations. In 2018-2020, there was little interest in some energy auctions. One of the reasons was, next to the auction system, that the FIT/FIP mechanism was introduced for hydropower and biogas installations. Electricity producers preferred that mechanism as it was less demanding and less risky. According to NIK, an obvious reason for the incomplete sale of energy offered in auctions was that the quantity and value of that energy was not tailored to the real market demand. Also there was no current information about basic auction parameters – the quantity and value of energy designed for sale and its reference price.

The increase in the number and the installed power of new installations was also triggered by the FIT/FIP mechanism. From the moment it was used, 473 certificates were issued about the possibility of selling electricity at a fixed purchase price. The quantity of electric energy produced by prosumers was growing systematically. At the end of the third quarter 2020, there were nearly 357 thousand micro-installations in Poland with the capacity of 2 358 MW.

Despite the increase in the quantity of installed power from RES and the increase in the number of installations, the targets set in the evaluation of consequences of the amended Act on RES of 2018 were not achieved. It was assumed that at the end of 2020 there would be about 130 new small water power stations with the capacity of 35 KW. As of 14 December 2020, there were 27 water power stations in the FIT/FIP mechanism. It was also assumed that about 100 new biogas installations with the capacity of 40 KW would be built. In terms of the installed power, the target was achieved in 40%, whereas in terms of the new biogas installations in was less than 20% (19 installations).

Also the target to establish one agricultural biogas plant on average by the end of 2020 in each commune using agricultural biomass was not met. There were 99 agricultural biomass producers in Poland as of 25 January 2021. At the beginning of 2021, there were 2 477 communes in Poland. Thus, only a small percentage of rural communes had at least one biogas plant. The target was not met because there were no support mechanisms in place.

Recommendations

NIK addressed two system recommendations to the Minister of Climate and Environment:

- to make a comprehensive analysis of the support of electricity producers from renewable sources, introduced with RES Act;

- to develop and implement system monitoring of RES market based on cooperation of all public administration bodies and RES sector organisations.

Other recommendations of NIK concerned:

- providing conditions for RES energy producers in the auction system and the FIT/FIP system within timeframes enabling the producers to get ready for auctions;

- intensifying efforts related to notification of the support measure for modernised and hybrid installations by the European Commission;

- immediately publishing three executive ordinances to the RES Act and the Energy Law.